Oracle shares rose 11% in extended trading on Thursday after the database software maker reported fiscal second-quarter earnings that exceeded analysts’ estimates.

Here’s how the company did:

- Earnings: $1.21 per share, adjusted, vs. $1.11 per share as expected by analysts, according to Refinitiv.

- Revenue: $10.36 billion vs. $10.21 billion as expected by analysts, according to Refinitiv.

Revenue increased 6% year over year in the quarter, which ended Nov. 30, according to a statement.

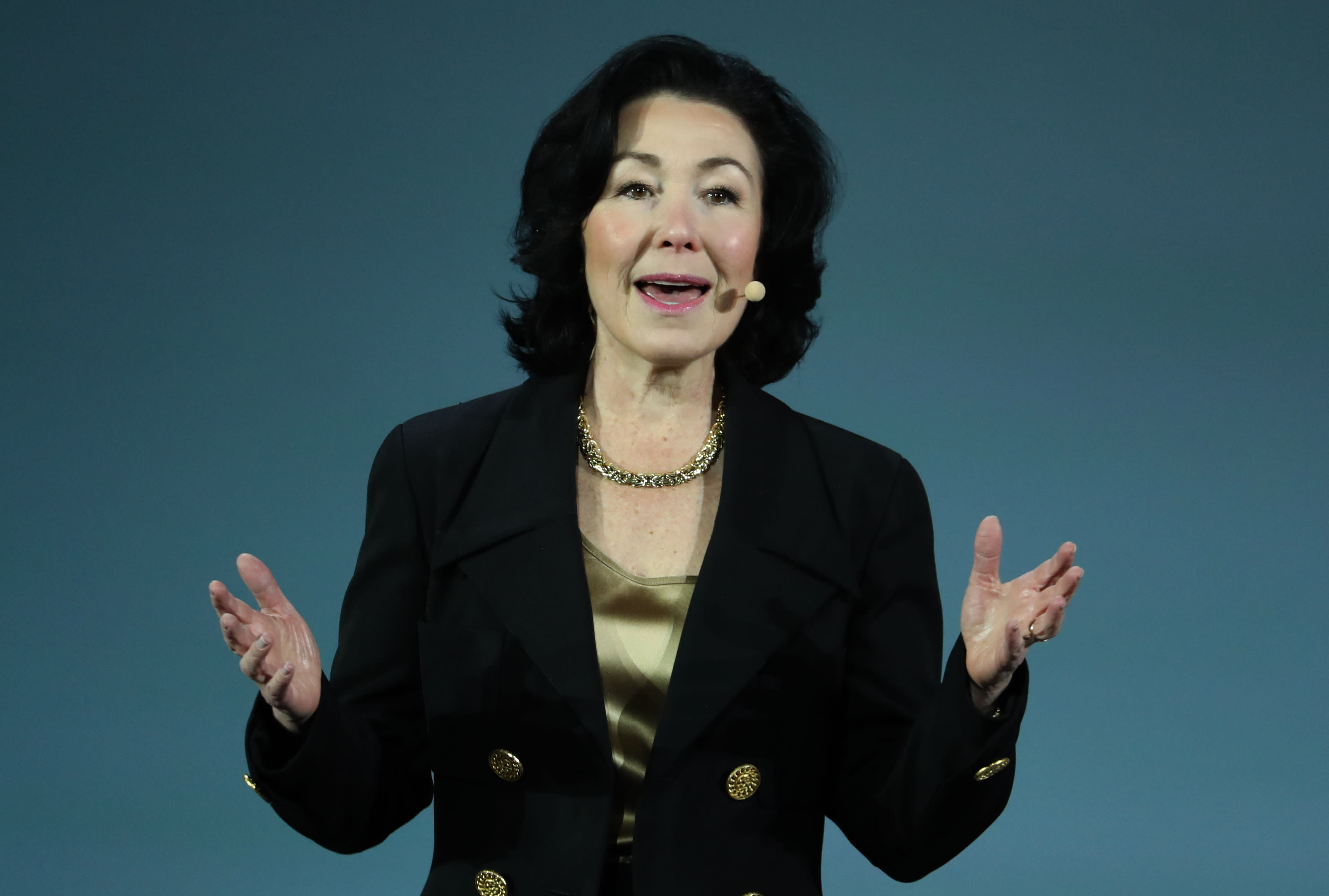

The company swung to a net loss of $1.25 billion from net income of $2.44 billion in the year-ago quarter. It made a payment for a judgment in a decade-long dispute stemming from former CEO Mark Hurd’s arrival at the company in 2010 from computer maker HP. Hurd later became co-CEO alongside Safra Catz until he died in 2019. Catz has since held the CEO title on her own.

Oracle reported $7.55 billion in cloud services and license support revenue, up 6% year over year and just above the StreetAccount consensus of $7.54 billion.

Cloud license and on-premises license revenue totaled $1.24 billion, up 13% and above the $1.07 billion consensus.

Oracle said it had $7.9 billion in short-term deferred revenue, below the $8.29 billion consensus.

In the quarter Oracle said it would open cloud data centers in Colombia, Israel, Italy, France, Mexico, Singapore, South Africa and Sweden.

With respect to guidance, Catz called for $1.14 to $1.18 in adjusted fiscal third-quarter earnings per share on 3% to 5% revenue growth. Analysts polled by Refinitiv had expected adjusted earnings of $1.16 per share and $10.56 billion in revenue, which would imply about 5% revenue growth.

Notwithstanding the after-hours move, Oracle stock is up 37% since the start of 2021, while the S&P 500 index is up about 25% over the same period.

WATCH: Oracle partners with telecom firm Bharti Airtel to scale up cloud computing services in India