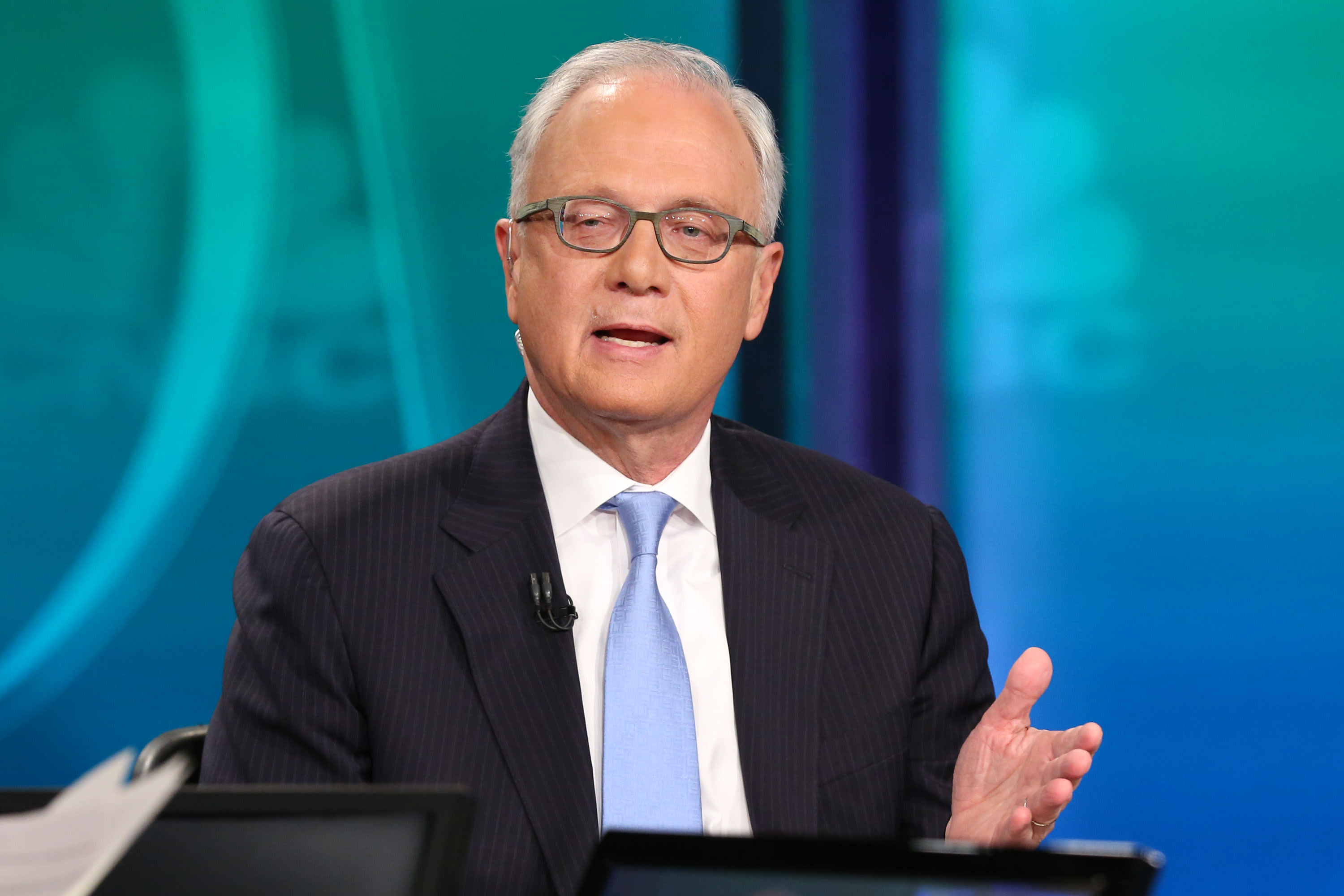

Long-time market bull Ed Yardeni is on correction watch.

The Yardeni Research President predicts more losses as investors look to lighten up on the historic rally’s biggest winners: Mega big cap growth stocks, particularly technology.

But he contends that’s not such a bad thing.

“The market has had a huge move since March 23. The Nasdaq is up something like 70%. That’s a melt-up. It’s not as big as what we had in 1999 when we had over 200%. But I wouldn’t want to see a repeat of that. So, I’m actually somewhat comforted by the market taking a break here,” he told CNBC’s “Trading Nation” on Friday. “It’s a healthy development.”

The tech-heavy Nasdaq is coming off its worst week since March 20. It closed on Friday down more than 6% from its Wednesday record high. Meanwhile, the S&P 500, which has significant exposure to tech, saw its worst week since June 26.

“It has been disconcerting to see that five stocks account for 25% of the market cap of the S&P 500,” said Yardeni. “But those are the stocks that are actually getting corrected here and are leading the way on the way down.”

Yardeni, who spent decades on Wall Street running investment strategy for firms including Prudential and Deutsche Bank, has been worried about a mother of all market melt-ups sparking a meltdown. He warned investors on “Trading Nation” in mid-July that stocks were approaching frothy levels based on valuations.

Now, he believes the overall market is vulnerable to a 10% to 15% sell-off. Yardeni expects it’ll last days instead of weeks or months, and usher in a leadership change.

Despite his view underlying fundamentals for tech stocks remain strong, he expects an improving economy paired with a potential coronavirus vaccine within months should make cyclicals more attractive.

“There is so much cash out there”

Ed Yardeni

Yardeni Research President

“We may very well see a broadening into what people call value stocks — more specifically into financial stocks, for example,” said Yardeni. “But that doesn’t mean that technology doesn’t make a comeback as well. There is so much cash out there that was raised during the mad dash for cash in March, and that has been provided by fiscal and monetary policy.”

His base case is the S&P 500 ends the year at 3,500, which implies a 2% gain from Friday’s close.

“I’m kind of rooting for this market to consolidate for the next several months,” Yardeni said. “But I think next year we could get up to 3,800 — maybe a little higher than that.”